TReDS in India

TReDS in India

It is a RBI initiative that enables SMEs (Small & Medium Enterprises) to discount their trade receivables with corporate buyers through various financiers. This mechanism aims to improve the trade receivable management of SMEs. The system has significantly enhanced the competitiveness of SMEs by addressing their critical working capital needs by providing easy access to funds, competitive discounting rates, fully digital process and seamless data flow. It empowers stakeholders with its 24 hrs TAT, 100% trust, transparency, digital flows and easy accessibility.

Read MoreThe Features of TReDS

TReDS is a digital platform designed to enhance working capital management for MSMEs by enabling invoice discounting. Here are some key features of TReDS:

Seamless Digital Process: Platforms like Bunny Bucks TReDS offer a fully digital experience, where businesses can register and manage invoices online through the TReDS portal.

Easy Registration: MSMEs, corporate buyers, and financiers can complete TReDS registration online, providing access to a network of financiers.

Invoice Discounting: MSMEs upload invoices on the TReDS platform, and once approved by the buyer, financiers offer competitive rates to discount the invoices.

Transparency & Security: The process is transparent and regulated by the RBI, ensuring a secure and efficient environment for all participants.

Quick Cash Flow: TReDS login enables MSMEs to access immediate funds against unpaid invoices, enhancing liquidity without taking on additional debt.

Overall, TReDS platforms in India provide a robust solution for businesses to optimise cash flow and streamline trade receivable management.

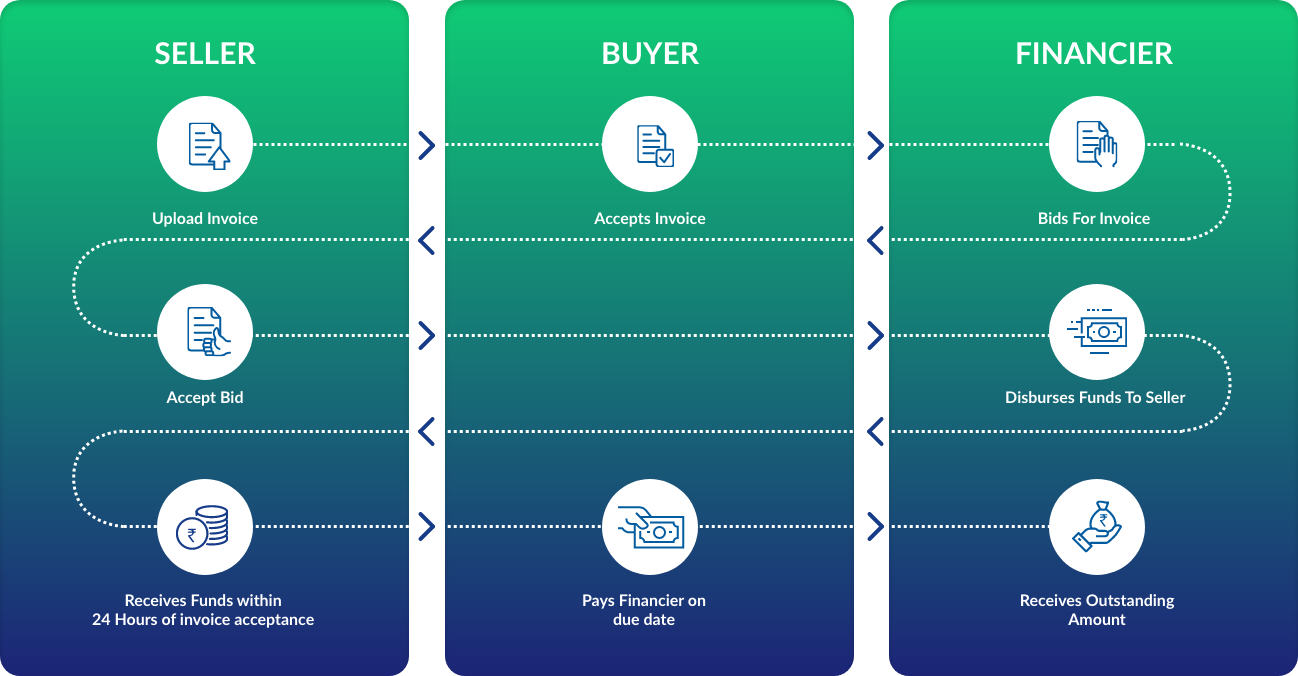

How it works

Transactions on TReDS platform are conducted digitally and start when the SME supplier of goods & services raises the invoice, and the buyer validates the same. This permits the financiers (Banks/ NBFCs) to bid against the verified and approved invoice. Once the supplier accepts the bid, payment is processed in 1 day and credited to the SMEs bank account.

Benefits

TReDS | Empowering stakeholders, with

TReDS enabling Deep Tier Finance

Small-to-Small (S2S) is a deep-tier financing system introduced by Bunny Bucks under the aegis of the RBI to extend the benefits of invoice financing to the entire spectrum of SMEs. Powered by a cutting-edge credit risk evaluation engine, S2S Financing evaluates businesses, fostering financial hygiene and rewarding growth-oriented enterprises.

01.

Initiation

The process begins when an SME (acting as a buyer) initiates a transaction by submitting receivables from Tier-2 or Tier-3 suppliers onto the platform. These suppliers can now seek early payment by discounting their receivables.

02.

Verification

The receivables submitted are verified by the buyer (the SME), ensuring they are legitimate and accurate. This verification is essential for maintaining the integrity of the transactions.

03.

Discounting

Once verified, the receivables are available for discounting by financiers on the platform. Suppliers can access funds by selling their receivables at discounted rates, thus receiving early payment.

04.

Settlement

Once verified, the receivables are available for discounting by financiers on the platform. Suppliers can access funds by selling their receivables at discounted rates, thus receiving early payment.

- Invoice uploading

- Buyer acceptance

- Discounting

- Payment

- Accessibilty

- 24/7 Customer Support

- Evaluating Your Progress

- Continuous Improvement

- 24/7 Customer Support

Faq’s

Frequently Asked Questions

-

Q1. What is TReDS, and how does it benefit MSMEs in India?

Ans. TReDS is an RBI-regulated platform that allows MSMEs to get their invoices discounted by financiers, ensuring quick access to working capital. Platforms like Bunny Bucks TReDS provide a seamless TReDS online experience where MSMEs can complete TReDS registration online, upload invoices via the TReDS portal, and receive upfront payment. Once invoices are approved by corporate buyers, financiers on the TReDS platform bid to offer the best discounting rates. MSMEs benefit by improving cash flow without incurring debt, while buyers and financiers can manage their receivables efficiently. TReDS platforms in India help MSMEs manage liquidity and grow their businesses.

-

Q2. Who can participate on a TReDS platform?

Ans. TReDS platforms in India, such as Bunny Bucks TReDS, allow three types of participants:

MSMEs:

Businesses can register on the platform through TReDS registration online, upload their invoices, and access early payments.Corporate Buyers:

Companies can approve invoices uploaded by MSMEs on the TReDS portal and facilitate invoice financing.Financiers:

Banks, financial institutions, and NBFCs can bid to discount invoices, offering competitive rates to MSMEs.

All participants can access the platform via their TReDS login, ensuring secure and efficient management of invoices and working capital. TReDS online facilitates seamless interaction between sellers, buyers, and financiers for smooth financial transactions.

-

Q3. What is TReDS and how does it benefit MSMEs?

Ans. TReDS is a digital platform that helps MSMEs get immediate access to working capital by discounting their invoices. Through platforms like Bunny Bucks TReDS, MSMEs can complete TReDS registration online, upload invoices on the TReDS portal, and secure upfront payments. Once corporate buyers approve the invoices, financiers on the TReDS platform offer competitive rates to discount the invoices. MSMEs benefit by improving liquidity without taking on debt, allowing them to manage cash flow effectively. TReDS platforms in India enable a seamless, transparent process, enhancing financial inclusion for MSMEs and supporting their growth.

-

Q4. How do sellers, buyers, and financiers interact on the TReDS platform?

Ans. On TReDS platforms in India, such as Bunny Bucks TReDS, the interaction between sellers, buyers, and financiers is streamlined through a digital process.

Sellers (MSMEs):

After completing TReDS registration online, MSMEs log in via TReDS login, upload invoices on the TReDS portal, and seek early payment.Buyers (Corporate Buyers):

Corporate buyers approve or reject the invoices uploaded by sellers on the platform.Financiers:

Banks, financial institutions, and NBFCs bid on the invoices to offer the best discounting rates, providing immediate liquidity to sellers.

This seamless interaction on the TReDS platform ensures faster processing and transparent financing.

-

Q5. What are the eligibility criteria for registering on TReDS?

Ans. To register on TReDS platforms in India like Bunny Bucks TReDS, the following eligibility criteria apply:

MSMEs:

Must be a micro, small, or medium enterprise as per the MSME Act.Corporate Buyers:

Large corporates with an annual turnover above ₹250 crore are eligible to onboard as buyers.Financiers:

Banks, financial institutions, and NBFCs can participate as financiers on the platform.

-

Q6. How does the discounting process work on a TReDS platform?

Ans. The discounting process on TReDS platforms in India, such as Bunny Bucks TReDS, works as follows:

- Sellers (MSMEs) register on the platform via TReDS registration online, upload invoices to the TReDS portal, and request financing.

- Buyers (Corporate Buyers) approve the invoices, confirming their validity.

- Financiers (banks, financial institutions, NBFCs) then bid on the invoices, offering competitive discounting rates.

- Once a bid is accepted, the seller receives the discounted amount upfront, improving cash flow.

The process is managed securely through TReDS, providing a seamless, efficient, and transparent invoice financing solution for all participants.